- Created by user-8f2bd, last modified by user-5c3b0 on Jun 13, 2019

Overview

Zeta Optima Leave & Travel Allowance (LTA) Card is a paperless and digital solution designed to facilitate organizations to allow employees to claim their LTA expenses electronically. Let us now examine certain guidelines for setting up the LTA program.

Claim Creation by Corporate Employees

Employees will upload claims by filling in the details of all individual trips of a journey. Employees will also have to declare that all the trips claimed are part of a single journey.

Claim Processing by Zeta

Zeta will not allow partial approval of LTA claims. If any information (dates, proofs, documents, etc) is deemed incorrect/incomplete by Zeta, then we will reject the claim altogether. The user has to upload the claim again with corrected details.

Proof of Leave

Proof of Leave has to be mandatorily submitted by the employees with every claim. All dates of travel of all trips of the claim must fall within the leave period, else the claim will be rejected by Zeta.

Valid documents for proof of leave are:

Image of approved leave application

Screenshot of approved leave application email

Proof of Travel

The valid documents required for proof of travel are:

- When mode of journey is flight:

- Tickets with booking date clearly visible

- Boarding pass or travel certificate issued by the airline

- When mode of journey is train, bus or cab:

- Tickets or receipts issued by the travel agency

What is an LTA Block?

LTA block years are blocks of 4 calendar years created by Income Tax Department.

| Block Number | Period |

|---|---|

| 1 | 1986-89 |

| 2 | 1990-93 |

| 3 | 1994-97 |

| 4 | 1998-01 |

| 5 | 2002-05 |

| 6 | 2006-09 |

| 7 | 2010-13 |

| 8 | 2014-17 |

| 9 | 2018-21 |

Corporate must allot the limits for every employee to Zeta, through the LTA order file at the start of LTA program administration. Zeta will ensure that only the specified number of claims are approved for the employee in the LTA block.

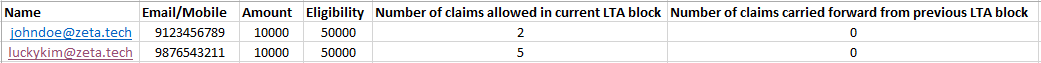

The LTA order file has two additional columns against every employee:

Number of claims allowed for current LTA block.

Number of claims carried forward from previous LTA block.

Claims carried forward from previous LTA block, is subject to the condition that this claim is used in the first year of the subsequent LTA block.

Limits on Number of LTA Claims per Employee

The Income Tax regulation puts a cap on the number of times an employee can claim for LTA in an LTA block of four calendar years. The suggested limits are:

Maximum two claims by the employee in the current LTA block of four calendar years.

Maximum one claim carried forward by the employee from the previous LTA block, subject to the condition that this claim is used in the first year of the subsequent LTA block.

The commonly followed process is allowing 2 claims in a block of 4 years. However, it is open for the corporate specify any count in the order file for their employees.

Working of Limits

Updating both values is possible with every new order. Values are overwritten whenever new values are entered by the HR (all updates will be per employee). The new values are honored irrespective of old values.

If the old value was 2 and the new value is 3, then:

If no claims are approved (before updating), we allow 3 more claim approvals

If 1 claim is already approved (before updating), we allow 2 more claim approvals

If 2 claims are already approved (before updating), we allow one more claim approval

If the old value was 2 and the new value is 1, then:

If no claims are approved (before updating), we allow 1 more claim approval

If 1 claim is already approved (before updating), we do not allow any more claim approval

If 2 claims are already approved (before updating), we do not allow any more claim approval. Also, we DO NOT reprocess the already approved 2 claims

Zeta Recommendation: Tax Exemption Calculation

Along with claim approved amount, Zeta also provides a suggested exempt amount for every LTA claim approved. The calculation for the suggested exempt is done as follows:

Every trip of the claim is considered independently for calculation.

Air India fares is considered for all flight fare calculations. Actuals will be considered if Air India fares are not available.

One A/C train fare is considered for all train journeys and private cab journeys.

State bus fares is considered for bus journeys. One A/C train fare will be considered, if state bus fares are not available.

- The final amount reported will be a minimum of the claimed amount and the suggested exempt amount.

- It is completely up to the organization to choose to use/ not use the suggested exempt amount provided by Zeta.

- No labels