- Created by Seema, last modified by user-5c3b0 on Jun 13, 2019

Overview

The Zeta gift card program is a digital, simple and paperless solution that lets you easily and quickly spend your gift vouchers. The program is a flexible and one-stop solution to all your past worries e.g., restricted redeem option to the listed merchants only, need of an account to use online coupons, storing physical gift vouchers and probability of missing the validity date.

Zeta gift vouchers are carefully designed to offer you a great deal of freedom to spend your gift money anywhere and to track your expenses, thus maximizing your shopping joy. The Zeta gift card program lets employees or users pay and analyze their gift purchases using the Zeta App interface.

Install the Zeta app on your smartphone from app store. To download and configure Zeta app, see Setting up an Employee Account.

Useful Facts

Per IT rule, a value of gift voucher up to Rs. 5000/- is not taxable. This exemption is applicable only when the gift voucher is a non-monetary instrument.

KYC declaration is mandatory if you receive gift vouchers above Rs. 50000/-.

Zeta digital gift vouchers are a non-transferable instrument and comply with IT guidelines.

Gift card is accepted everywhere including Zeta-affiliated (online and offline mode) and non-affiliated merchants. However, your company may issue a vendor specific e-gift card that you can only use at the listed vendor site.

Zeta gift vouchers are valid for 3 years from the date of issue.

Gift vouchers can not be encashed and can only be used online and offline using Zeta app and super card.

Gift vouchers are temporary in nature and once used are disappeared from your card disposal.

Remember

All your reimbursement instruments get closed after every financial year end and the following settlements are done for any outstanding balance in your cards and the amount stuck in your holding account:

- Any remaining amount can either be transferred in full to your Cash Card and appropriate tax deductions can be made while processing payroll or the remaining amount could be recalled and credited as part of your payroll, after making appropriate deductions, as per your company's policy.

- Any claim uploaded and approved but the amount not reimbursed into the cash card due to non-compliance with the KYC or PPI limit is paid to you as a part of your monthly salary with no tax deductions.

Before You Begin

Ensure the following:

You’ve received a digital Zeta gift card from your corporate HR.

You’ve appropriate balance in your gift or super cards to initiate payment through Zeta platform and to avoid transaction declined error.

How Gift Card Flow Works?

The Zeta Gift Card program provides a simple and hassle-free workflow to transact your gift money. All you need to do is:

Receive a Zeta gift card from your corporate HR.

Use your gift money online or offline at any merchant sites using the Zeta app or Zeta Super Card.

View transaction history using the app.

For a quick walkthrough, navigate to Cards > Gift Vouchers, tap the gift voucher screen and then click User Guide. This opens up a tutorial as explained above.

Using the Zeta Gift Interface

The Zeta gift card provides an intuitive interface to exercise your tax-free rewards and most importantly, to track your gift card spending electronically. Unlike other existing digital or traditional gift card, Zeta offers you a great deal of flexibility to spend your gift money the way you want in the following way:

You can spend your gift money anywhere you want without any restriction, for example, buying books, refilling fuel or purchasing any household items and groceries.

You can decide to spend your money in one single purchase or multiple purchases.

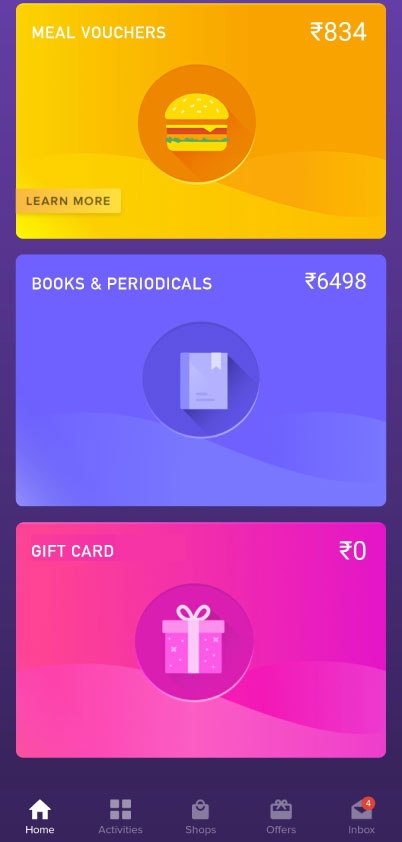

Under the Home tab, your active gift voucher would appear as shown below in the card stack:

Using the Zeta gift interface, you can perform the following tasks: