- Created by user-8f2bd, last modified on Sep 22, 2017

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 3 Next »

Overview

Zeta Optima provides a one-stop solution to avail various employee tax benefits under one roof. It has a wide ranging suite of products that help manage various employee tax benefits. Optima is fully compliant with RBI, Income Tax and Information Technology regulations. Let us now examine some of the vital guidelines that we must abide by :-

Reserve Bank Of India : The issuance of any form of paid vouchers in the entire country is governed by the Reserve Bank of India and as such must abide by the guidelines issued by RBI.

Information Technology : The Information Technology act under Section 43A, has specifically mentioned that, organisations - be it of any stature which deals with the sensitive personal data of customers, has to follow proper procedures to ensure their security; in the absence of which, the organisation will be liable to pay for the damages incurred.

Income tax : Annual taxes are levied by the federal government and most state governments on individual and business income. By law, businesses and individuals must file federal and state income tax returns every year to determine whether they owe taxes.

Meal Card Compliance

Zeta Meal Vouchers are semi-closed non-reloadable co-branded prepaid instruments issued by RBL Bank (formerly known The Ratnakar Bank) and marketed & distributed by Better World Technology Pvt. Ltd (BWTPL). Let us now examine the Meal Card with respect to it's compliance with Government regulations.

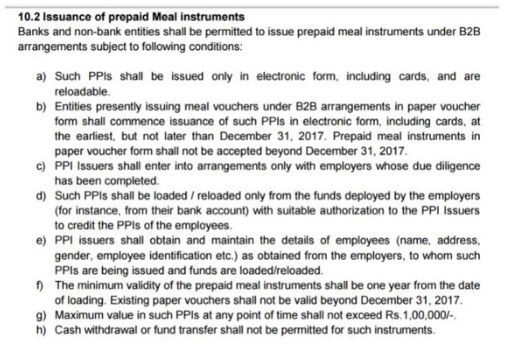

RBI Guidelines

The following are extracts from the RBI's Draft Master Direction:

- RBI says ''No Paper Meal Vouchers''.

- Prepaid Instruments (PPI) in paper voucher form shall not be accepted beyond December 31, 2017.

- The maximum value in such PPIs, at any point of time, shall not exceed Rs. 1,00,000/-.

- The minimum validity of the PPI will be one year from the date of loading.

RBI Draft Master Direction

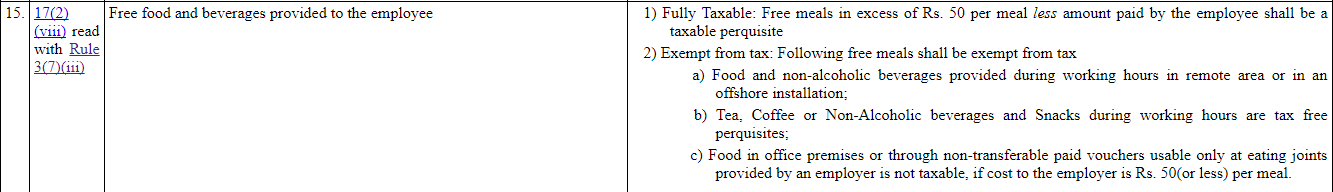

Income Tax Act

Section 3(7)(iii) of the Income Tax Rules states that:

- Meal vouchers are Non-Transferable.

- Meal vouchers are to be used only at eating joints.

- Meal vouchers cannot exceed the limit of Rs. 50 per meal. The progressive monthly value of meal vouchers is governed by the company.

Section 3(7)(iii)

Bank issued meal cards which are in the form of Debit / Pre-Paid card does not meet the definition of a voucher, as it is not a genuine voucher.

Where does Zeta stand?

The below comparison table summarizes how the Zeta Meal Vouchers are the only 100% digital compliant solution, under the RBI guidelines and Income tax rules.

| Paper Vouchers | Meal Cards | Zeta Meal Vouchers | |

|---|---|---|---|

Reserve Bank Compliant Income Tax Compliant Tax-Benefits to Employees | X √ √ | √ X X | √ √ √ |

Medical Card Compliance

Optima medical card allows employees to pay, upload, manage and review the medical bills using the Zeta App interface. Let us now examine the Medical Card with respect to it's compliance with Government regulations.

Income Tax Act

Section 17(2) of the Income Tax Rules states that:

- Employee should have spent the amount on medical treatment.

- Employee should have spent the amount on his own or his family member's treatment.

- Such amount must be reimbursed by the employer.

- Employee can avail tax-free benefit of the expenditure incurred by him, limited to the extent of Rs. 15,000.

Section 17(2)

You can reimburse the medical expenses of only the current financial year and not of any previous years.

Income Tax Act (For Medical Treatment Outside India)

Section 17(2) of Income Tax Rules pertaining to medical treatment outside India, states that:

- Expense incurred by the employer on treatment of the employee or his family members outside India, can also avail tax-free benefits, to the extent permitted by RBI.

- Expenses on stay abroad for the employee or any member of his family and one attendant who accompanies them with regard to the treatment, is also a tax-free perquisite to the extent permitted by RBI.

- Cost on travel of the employee or any family member or one attendant is also tax-free, only if the Gross Total Income before including the travelling expense as a perquisite, does not exceed Rs. 2,00,000.

Income Tax Act (For Scanned Medical Bills)

The Information Technology Act, 2000 says that:

An electronic record can be authenticated by affixing the digital signature.

Read more..The Information Technology Act, 2000 (Chapter II):

Authentication of electronic records.

(1) Subject to the provisions of this section any subscriber may authenticate an electronic record by affixing his digital signature.

Electronic records can be used wherever a document is required.

Read more..The Information Technology Act, 2000 (Chapter III):

Legal recognition of electronic records.

Where any law provides that information or any other matter shall be in writing or in the typewritten or printed form, then, notwithstanding anything contained in such law, such requirement shall be deemed to have been satisfied if such information or matter is—

(a) rendered or made available in an electronic form

(b) accessible so as to be usable for a subsequent reference

If any information is to be retained for any specific period, then such information must be accessible for subsequent reference.

Read more..Retention of electronic records.

(1) Where any law provides that documents, records or information shall be retained for any specific period, then, that requirement shall be deemed to have been satisfied if such documents, records or information are retained in the electronic form, if—

(a) the information contained therein remains accessible so as to be usable for a subsequent reference;

(b) the electronic record is retained in the format in which it was originally generated, sent or received or in a format which can be demonstrated to represent accurately the information originally generated, sent or received;

(c) the details which will facilitate the identification of the origin, destination, date and time of dispatch or receipt of such electronic record are available in the electronic record: Provided that this clause does not apply to any information which is automatically generated solely for the purpose of enabling an electronic record to be dispatched or received.

An electronic record will be attributed to the person who sent it.

Read more..Attribution of electronic records.

An electronic record shall be attributed to the originator:-

(a) if it was sent by the originator himself;

(b) by a person who had the authority to act on behalf of the originator in respect of that electronic record; or

(c) by an information system programmed by or on behalf of the originator to operate automatically

Where Does Zeta Stand?

- You can initiate medical bill payments to both Zeta-affiliated (online and offline mode) and non-affiliated medical merchants.

- At Zeta, bill upload and approval is done electronically complying with the IT Act, 2000. All bill uploads, approvals, reimbursements and debits are digitally signed as per the regulations of the Information Technology Act. All bills are processed keeping highest process standards - ISO 27001:2013 process certified.

- At Zeta, the scanned medical bills are preserved in original format as uploaded by the employees. We do not tamper or modify these bills. These bills are tax saving documents, which are stored forever on Zeta servers and can be produced as originally uploaded.

Communication Card Compliance

This benefit is extended by an employer to an employee for expenses related to telephone, mobile phone and Internet bills. The following requirements should be met :

- The Phone/ Internet connection should be in the employee’s name.

- It is mandatory for the employee to submit the bills as evidence of the money spent.

Let us now examine the Communication Card with respect to it's compliance with Government regulations.

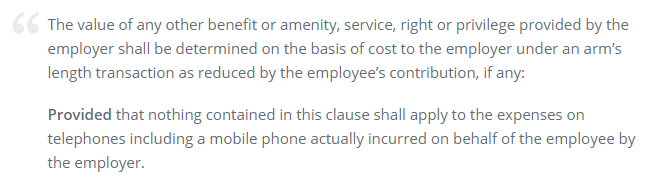

Income Tax Act

Section 3(7)(ix) of Income Tax rules states that:

- Communication expenses incurred by an employee as part of work, are reimbursable and non-taxable in the hands of the employee.

- The rule includes both Land line and Mobile connections, as well as Internet connection. Data card connections are also included, as data card is just a SIM card.

- The Act does not specify the maximum number of connections allowed for reimbursements and tax exemption.

- The connections have to be in the name of the employee.

- Expenses incurred towards both Pre-paid and Post-paid mobile connections are non-taxable.

Section 3(7)(ix)

Income Tax Act (For Scanned Communication Bills)

The Information Technology Act, 2000 says that:

An electronic record can be authenticated by affixing the digital signature.

Read more..The Information Technology Act, 2000 (Chapter II):

Authentication of electronic records.

(1) Subject to the provisions of this section any subscriber may authenticate an electronic record by affixing his digital signature.

Electronic records can be used wherever a document is required.

Read more..The Information Technology Act, 2000 (Chapter III):

Legal recognition of electronic records.

Where any law provides that information or any other matter shall be in writing or in the typewritten or printed form, then, notwithstanding anything contained in such law, such requirement shall be deemed to have been satisfied if such information or matter is—

(a) rendered or made available in an electronic form

(b) accessible so as to be usable for a subsequent reference

If any information is to be retained for any specific period, then such information must be accessible for subsequent reference.

Read more..Retention of electronic records.

(1) Where any law provides that documents, records or information shall be retained for any specific period, then, that requirement shall be deemed to have been satisfied if such documents, records or information are retained in the electronic form, if—

(a) the information contained therein remains accessible so as to be usable for a subsequent reference;

(b) the electronic record is retained in the format in which it was originally generated, sent or received or in a format which can be demonstrated to represent accurately the information originally generated, sent or received;

(c) the details which will facilitate the identification of the origin, destination, date and time of dispatch or receipt of such electronic record are available in the electronic record: Provided that this clause does not apply to any information which is automatically generated solely for the purpose of enabling an electronic record to be dispatched or received.

An electronic record will be attributed to the person who sent it.

Read more..Attribution of electronic records.

An electronic record shall be attributed to the originator:-

(a) if it was sent by the originator himself;

(b) by a person who had the authority to act on behalf of the originator in respect of that electronic record; or

(c) by an information system programmed by or on behalf of the originator to operate automatically

Where does Zeta stand?

- Users can pay bills for their configured connections through the Zeta App itself. The amount gets deducted from the communications card in this case.

- The communication card balance also gets utilized while re-charging or paying bills through the shops interface.

- At Zeta, bill upload and approval is done electronically complying with the IT Act, 2000. All bill uploads, approvals, reimbursements and debits are digitally signed as per the regulations of the Information Technology Act. All bills are processed keeping highest process standards - ISO 27001:2013 process certified.

At Zeta, the scanned Communication bills are preserved in original format as uploaded by the employees. We do not tamper or modify these bills. These bills are tax saving documents, which are stored forever on Zeta servers and can be produced as originally uploaded.

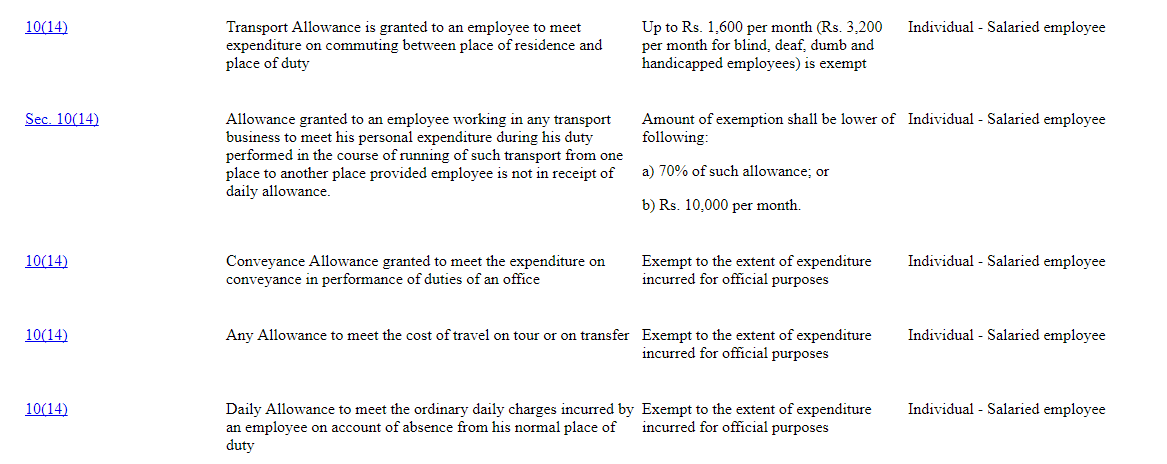

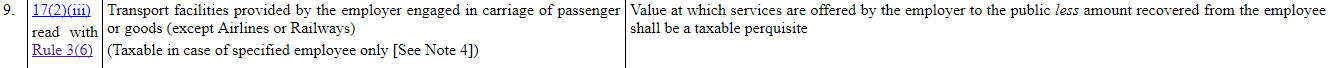

Fuel & Travel Card Compliance

The Optima Fuel & Travel Card is a digital card designed to help corporates to manage fuel and conveyance expenses program. Let us now examine the Fuel & Travel Card with respect to it's compliance with Government regulations.

Income Tax Act

Section 10(14) and Rule 2BB of Income Tax Rules states:

Fuel & Travel allowance is offered to Employees of a company, to compensate for their travel between residence and place of work up to Rs. 1,600 per month (Rs. 3,200 per month for blind, deaf, dumb and handicapped employees) and is tax exempted.

Fuel & Travel allowance is offered to Employees on top of their Basic Salary component.

It is paid by an Employer, only if the there is no transportation provided by the Employer. In case an Employer offers office transport, conveyance allowance will not be provided to Employees.

Section 10(14)

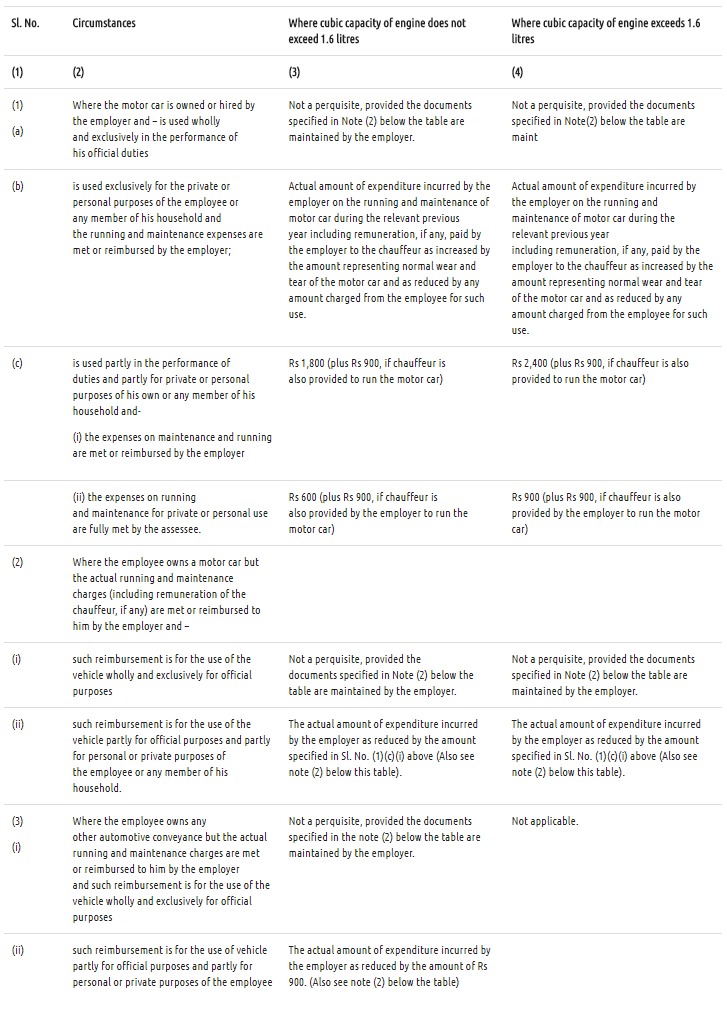

There are mainly 3 factors determining the taxation policies for Fuel and Travel allowance: -

- Car Ownership

- Car Usage

- Cubic Capacity of the car engine

In situations where the Employee owns the car, the following conditions have to be met to claim reimbursement:

The vehicle should be registered in the name of the Employee and a copy of the RC (Registration Certificate) book must be submitted as proof of the same.

An Employee can claim for more than one vehicle, provided they are registered in his name.

Section 17(2)(iii) with Rule 3(2)

Income Tax Act (For Scanned Fuel & Travel Bills)

The Information Technology Act, 2000 says that:

An electronic record can be authenticated by affixing the digital signature.

Read more..The Information Technology Act, 2000 (Chapter II):

Authentication of electronic records.

(1) Subject to the provisions of this section any subscriber may authenticate an electronic record by affixing his digital signature.

Electronic records can be used wherever a document is required.

Read more..The Information Technology Act, 2000 (Chapter III):

Legal recognition of electronic records.

Where any law provides that information or any other matter shall be in writing or in the typewritten or printed form, then, notwithstanding anything contained in such law, such requirement shall be deemed to have been satisfied if such information or matter is—

(a) rendered or made available in an electronic form

(b) accessible so as to be usable for a subsequent reference

If any information is to be retained for any specific period, then such information must be accessible for subsequent reference.

Read more..Retention of electronic records.

(1) Where any law provides that documents, records or information shall be retained for any specific period, then, that requirement shall be deemed to have been satisfied if such documents, records or information are retained in the electronic form, if—

(a) the information contained therein remains accessible so as to be usable for a subsequent reference;

(b) the electronic record is retained in the format in which it was originally generated, sent or received or in a format which can be demonstrated to represent accurately the information originally generated, sent or received;

(c) the details which will facilitate the identification of the origin, destination, date and time of dispatch or receipt of such electronic record are available in the electronic record: Provided that this clause does not apply to any information which is automatically generated solely for the purpose of enabling an electronic record to be dispatched or received.

An electronic record will be attributed to the person who sent it.

Read more..Attribution of electronic records.

An electronic record shall be attributed to the originator:-

(a) if it was sent by the originator himself;

(b) by a person who had the authority to act on behalf of the originator in respect of that electronic record; or

(c) by an information system programmed by or on behalf of the originator to operate automatically

Driver's Salary Tax Exemption

Driver's salary is also exempt from tax and reimbursed by the company. The income tax law pertaining to driver’s salary is Section 17(2)(iii). Below is the summarized interpretation related to this specific law:-

When the Motor car is owned by the employer:

When the Motor car is owned by the employee:

Section 17(2)(iii)

Where does Zeta Stand?

- Zeta Optima Fuel & Travel Card balance can be spent for re-fuelling at petrol stations by paying through the MasterCard / Rupay powered Zeta Supercard.

- If the Corporate requires submission of proof, the employee after spending through Zeta, can choose a transaction against which the bill has to be uploaded.

- Users can spend through any other means (Credit / Debit Card, Cash etc.) and upload valid claims on the Zeta app with the required details to get the amount reimbursed into their Zeta cash cards.

- At Zeta, bill upload and approval is done electronically complying with the IT Act, 2000. All bill uploads, approvals, reimbursements and debits are digitally signed as per the regulations of the Information Technology Act. All bills are processed keeping highest process standards - ISO 27001:2013 process certified.

- At Zeta, the scanned Fuel & Travel bills are preserved in original format as uploaded by the employees. We do not tamper or modify these bills. These bills are tax saving documents, which are stored forever on Zeta servers and can be produced as originally uploaded.

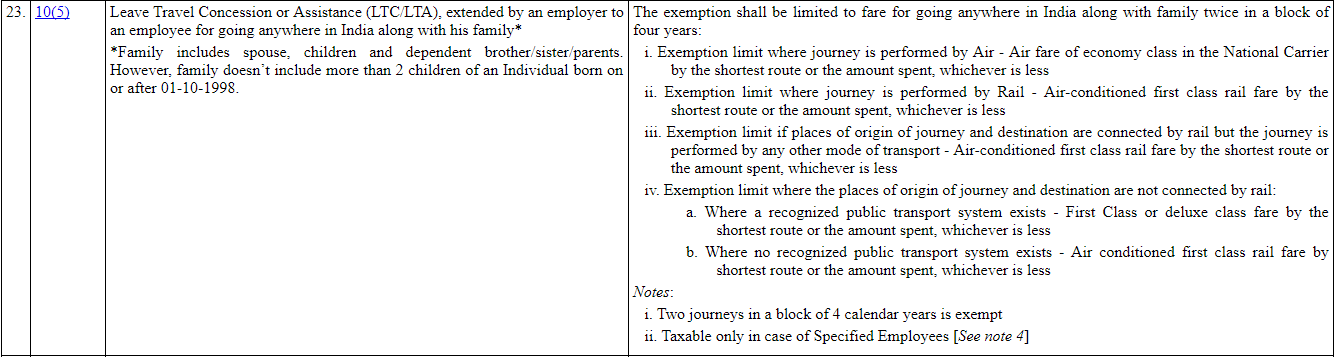

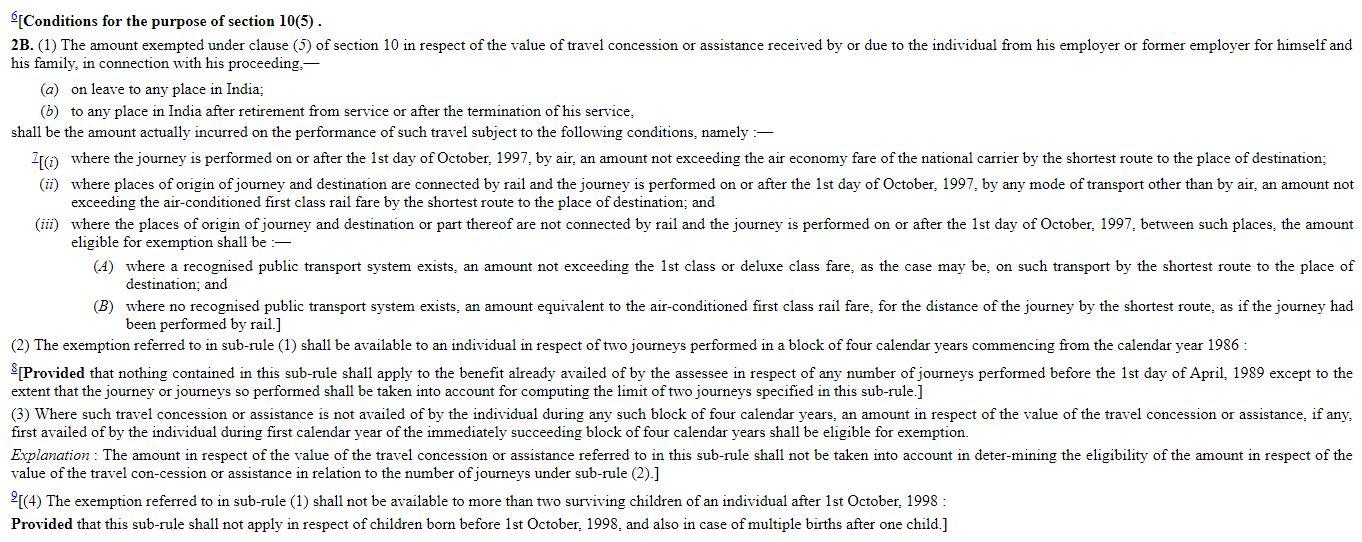

Leave & Travel Allowance Card Compliance

Zeta Optima Leave & travel Allowance (LTA) Card is a paperless and digital solution designed to facilitate organizations to allow employees to claim their LTA expenses electronically. Let us now examine the Leave & Travel Allowance Card with respect to it's compliance with Government regulations.

Income Tax Act

Section 10(5), Chapter 3 states that:-

- An individual can claim tax benefit on reimbursement claim to his/her employer or former employer if he/she is traveling within the country alone or with his/her family.

- This claim should not exceed the actual cost of travel. It only covers the travel ticket costs. Other additional costs like local travel, sightseeing, etc are not covered.

- Parents, Spouse, Siblings and Children of the employee availing LTA exemption are also covered, provided they fulfill certain criteria.

- There are further conditions about what exactly can be claimed for tax benefits in terms of the mode of travel, the number of times the benefit can be claimed in specific block of time and what would happen in fringe cases.

Section 10(5), Chapter 3, 1961

Certain conditions have to be met for the purpose of Section 10(5).

Rule 2(B)

Income Tax Act (For Scanned Leave & Travel Allowance Bills)

The Information Technology Act, 2000 says that:

An electronic record can be authenticated by affixing the digital signature.

Read more..The Information Technology Act, 2000 (Chapter II):

Authentication of electronic records.

(1) Subject to the provisions of this section any subscriber may authenticate an electronic record by affixing his digital signature.

Electronic records can be used wherever a document is required.

Read more..The Information Technology Act, 2000 (Chapter III):

Legal recognition of electronic records.

Where any law provides that information or any other matter shall be in writing or in the typewritten or printed form, then, notwithstanding anything contained in such law, such requirement shall be deemed to have been satisfied if such information or matter is—

(a) rendered or made available in an electronic form

(b) accessible so as to be usable for a subsequent reference

If any information is to be retained for any specific period, then such information must be accessible for subsequent reference.

Read more..Retention of electronic records.

(1) Where any law provides that documents, records or information shall be retained for any specific period, then, that requirement shall be deemed to have been satisfied if such documents, records or information are retained in the electronic form, if—

(a) the information contained therein remains accessible so as to be usable for a subsequent reference;

(b) the electronic record is retained in the format in which it was originally generated, sent or received or in a format which can be demonstrated to represent accurately the information originally generated, sent or received;

(c) the details which will facilitate the identification of the origin, destination, date and time of dispatch or receipt of such electronic record are available in the electronic record: Provided that this clause does not apply to any information which is automatically generated solely for the purpose of enabling an electronic record to be dispatched or received.

An electronic record will be attributed to the person who sent it.

Read more..Attribution of electronic records.

An electronic record shall be attributed to the originator:-

(a) if it was sent by the originator himself;

(b) by a person who had the authority to act on behalf of the originator in respect of that electronic record; or

(c) by an information system programmed by or on behalf of the originator to operate automatically.

Where Does Zeta Stand?

- Zeta recommends you to furnish KYC information using the Zeta app to upgrade your card limit and to avoid rejection of any amount beyond the KYC limit as set by RBI while using the Optima LTA card services.

- You can avail income tax benefit up to 2 LTA claims in a 4 block year provided you furnish supporting documents to your employer.

- You can pay for your travel tickets using the Zeta app or super card.

- At Zeta, bill upload and approval is done electronically complying with the IT Act, 2000. All bill uploads, approvals, reimbursements and debits are digitally signed as per the regulations of the Information Technology Act. All bills are processed keeping highest process standards - ISO 27001:2013 process certified.

- At Zeta, the scanned Leave & Travel Allowance bills are preserved in original format as uploaded by the employees. We do not tamper or modify these bills. These bills are tax saving documents, which are stored forever on Zeta servers and can be produced as originally uploaded.

The current block is January 2014 to December 2017.

Asset Card Compliance

The Asset or Gadget Card is a perquisite that helps employees save income tax by purchasing electronic items and verifying their claims thereafter by uploading the relevant bill copies. Let us now examine the Asset Card with respect to it's compliance with Government regulations.

Income Tax Act

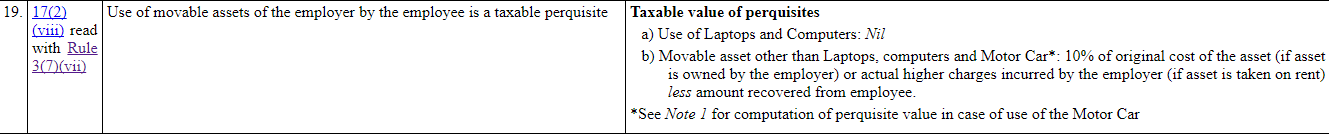

Section 17(2)(vii) of Income Tax rules states that :-

- The Assets (Laptops, Tablets and Smartphones) need to be for office use only by the employee.

- The bill has to be in the Employee’s name with Organization’s address.

- Laptop & Computers are fully tax exempt, with other gadgets taxed at 10% rate.

- Any Unclaimed amount by end of fiscal year is treated as taxable income.

- The bills have to be submitted for approval at all times, for both online/offline purchases.

Section 17(2)(vii)

Income Tax Act (For Scanned Asset Bills)

The Information Technology Act, 2000 says that:

An electronic record can be authenticated by affixing the digital signature.

Read more..The Information Technology Act, 2000 (Chapter II):

Authentication of electronic records.

(1) Subject to the provisions of this section any subscriber may authenticate an electronic record by affixing his digital signature.

Electronic records can be used wherever a document is required.

Read more..The Information Technology Act, 2000 (Chapter III):

Legal recognition of electronic records.

Where any law provides that information or any other matter shall be in writing or in the typewritten or printed form, then, notwithstanding anything contained in such law, such requirement shall be deemed to have been satisfied if such information or matter is—

(a) rendered or made available in an electronic form

(b) accessible so as to be usable for a subsequent reference

If any information is to be retained for any specific period, then such information must be accessible for subsequent reference.

Read more..Retention of electronic records.

(1) Where any law provides that documents, records or information shall be retained for any specific period, then, that requirement shall be deemed to have been satisfied if such documents, records or information are retained in the electronic form, if—

(a) the information contained therein remains accessible so as to be usable for a subsequent reference;

(b) the electronic record is retained in the format in which it was originally generated, sent or received or in a format which can be demonstrated to represent accurately the information originally generated, sent or received;

(c) the details which will facilitate the identification of the origin, destination, date and time of dispatch or receipt of such electronic record are available in the electronic record: Provided that this clause does not apply to any information which is automatically generated solely for the purpose of enabling an electronic record to be dispatched or received.

An electronic record will be attributed to the person who sent it.

Read more..Attribution of electronic records.

An electronic record shall be attributed to the originator:-

(a) if it was sent by the originator himself;

(b) by a person who had the authority to act on behalf of the originator in respect of that electronic record; or

(c) by an information system programmed by or on behalf of the originator to operate automatically

Where Does Zeta Stand?

- Zeta recommends you to furnish KYC information using the Zeta app to upgrade your card limit and to avoid rejection of higher amount transaction as set by RBI while using the Optima Asset Card services.

- You can pay for your asset purchase using the Zeta app or Zeta super card.

- You can make use of your cash card money if purchase amount is exceeding the asset card funds. In this case, you can claim tax benefits on approved asset card funds only.

- At Zeta, bill upload and approval is done electronically complying with the IT Act, 2000. All bill uploads, approvals, reimbursements and debits are digitally signed as per the regulations of the Information Technology Act. All bills are processed keeping highest process standards - ISO 27001:2013 process certified.

- At Zeta, the scanned asset bills are preserved in original format as uploaded by the employees. We do not tamper or modify these bills. These bills are tax saving documents, which are stored forever on Zeta servers and can be produced as originally uploaded.

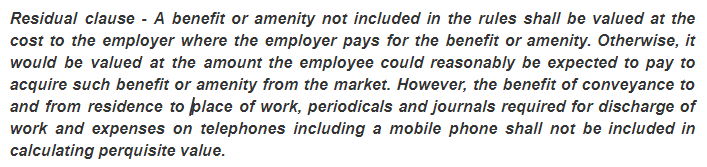

Books & Periodicals Card Compliance

The Books & Periodicals Card digitizes the whole process of claiming reimbursements for expenses on books and periodicals purchased for official purposes. Let us now examine the Books & Periodicals Card with respect to it's compliance with Government regulations:-

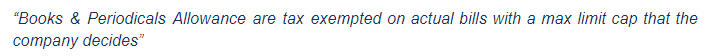

As per the Income Tax Act/Rule Section 10(14) in India, it is non-taxable if bills are submitted to and stored by an employer.

There is no cap set by the Income Tax department on Books& Periodicals.

However, a corporate can choose to set a cap for their employees according to their company policy.

Guideline

Residual Clause of Section 10(14)

Income Tax Act (For Scanned Books & Periodicals Bills)

The Information Technology Act, 2000 says that:

An electronic record can be authenticated by affixing the digital signature.

Read more..The Information Technology Act, 2000 (Chapter II):

Authentication of electronic records.

(1) Subject to the provisions of this section any subscriber may authenticate an electronic record by affixing his digital signature.

Electronic records can be used wherever a document is required.

Read more..The Information Technology Act, 2000 (Chapter III):

Legal recognition of electronic records.

Where any law provides that information or any other matter shall be in writing or in the typewritten or printed form, then, notwithstanding anything contained in such law, such requirement shall be deemed to have been satisfied if such information or matter is—

(a) rendered or made available in an electronic form

(b) accessible so as to be usable for a subsequent reference

If any information is to be retained for any specific period, then such information must be accessible for subsequent reference.

Read more..Retention of electronic records.

(1) Where any law provides that documents, records or information shall be retained for any specific period, then, that requirement shall be deemed to have been satisfied if such documents, records or information are retained in the electronic form, if—

(a) the information contained therein remains accessible so as to be usable for a subsequent reference;

(b) the electronic record is retained in the format in which it was originally generated, sent or received or in a format which can be demonstrated to represent accurately the information originally generated, sent or received;

(c) the details which will facilitate the identification of the origin, destination, date and time of dispatch or receipt of such electronic record are available in the electronic record: Provided that this clause does not apply to any information which is automatically generated solely for the purpose of enabling an electronic record to be dispatched or received.

An electronic record will be attributed to the person who sent it.

Read more..Attribution of electronic records.

An electronic record shall be attributed to the originator:-

(a) if it was sent by the originator himself;

(b) by a person who had the authority to act on behalf of the originator in respect of that electronic record; or

(c) by an information system programmed by or on behalf of the originator to operate automatically

Where Does Zeta Stand?

- Books & Periodicals vouchers are valid for 3 years and reimbursement is valid for one year.

- At Zeta, bill upload and approval is done electronically complying with the IT Act, 2000. All bill uploads, approvals, reimbursements and debits are digitally signed as per the regulations of the Information Technology Act. All bills are processed keeping highest process standards - ISO 27001:2013 process certified.

- At Zeta, the scanned Books & Periodicals bills are preserved in original format as uploaded by the employees. We do not tamper or modify these bills. These bills are tax saving documents, which are stored forever on Zeta servers and can be produced as originally uploaded.

Gift Card Compliance

Zeta Optima Gift Card program is designed to reward your employees for their valuable contribution or for other important events such as birthday, marriages, festivals and so on. . Let us now examine the Gift Card with respect to it's compliance with Government regulations.

Income Tax Act

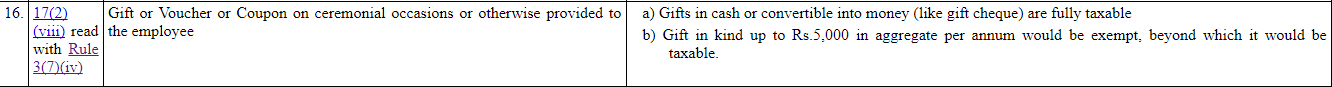

Section 17(2)(viii) of Income tax states that :-

- Gifts in cash or cheque which is convertible into money, are fully taxable by Income Tax Law.

- Gifts of value up to Rs. 5,000 per annum are fully exempt, beyond which it would be taxable.

- If employer has gifted more than once in the financial year, then such amount will be taxable only when the aggregate amount exceeds Rs. 5,000.

- Gift which is given to an employee by his/her employer on an occasion or which is given for exceptional performance or as an award may be taxable for the employee.

- Gifts can be received by the employee's family members on his/her behalf.

Section 17(2)(viii)

- Gifts worth up to Rs 50,000 presented to an employee by an employer, will not attract the Goods and Services Tax (GST).

Income Tax Act (For Scanned Asset Bills)

The Information Technology Act, 2000 says that:

An electronic record can be authenticated by affixing the digital signature.

Read more..The Information Technology Act, 2000 (Chapter II):

Authentication of electronic records.

(1) Subject to the provisions of this section any subscriber may authenticate an electronic record by affixing his digital signature.

Electronic records can be used wherever a document is required.

Read more..The Information Technology Act, 2000 (Chapter III):

Legal recognition of electronic records.

Where any law provides that information or any other matter shall be in writing or in the typewritten or printed form, then, notwithstanding anything contained in such law, such requirement shall be deemed to have been satisfied if such information or matter is—

(a) rendered or made available in an electronic form

(b) accessible so as to be usable for a subsequent reference

If any information is to be retained for any specific period, then such information must be accessible for subsequent reference.

Read more..Retention of electronic records.

(1) Where any law provides that documents, records or information shall be retained for any specific period, then, that requirement shall be deemed to have been satisfied if such documents, records or information are retained in the electronic form, if—

(a) the information contained therein remains accessible so as to be usable for a subsequent reference;

(b) the electronic record is retained in the format in which it was originally generated, sent or received or in a format which can be demonstrated to represent accurately the information originally generated, sent or received;

(c) the details which will facilitate the identification of the origin, destination, date and time of dispatch or receipt of such electronic record are available in the electronic record: Provided that this clause does not apply to any information which is automatically generated solely for the purpose of enabling an electronic record to be dispatched or received.

An electronic record will be attributed to the person who sent it.

Read more..Attribution of electronic records.

An electronic record shall be attributed to the originator:-

(a) if it was sent by the originator himself;

(b) by a person who had the authority to act on behalf of the originator in respect of that electronic record; or

(c) by an information system programmed by or on behalf of the originator to operate automatically

Where Does Zeta Stand?

- Zeta Gift Card is non-transferable and exempted from tax up to Rs. 5,000.

- As gifts can be of any kind, gift card can work as a universal card. Hence, when there is lack of money in any of the optima cards during any purchase, the remaining money needed to complete the transaction will be deducted from the Optima Gift Card.

- At Zeta, bill upload and approval is done electronically, complying with the IT Act, 2000. All bill uploads, approvals, reimbursements and debits are digitally signed as per the regulations of the Information Technology Act. All bills are processed keeping highest process standards - ISO 27001:2013 process certified.

- At Zeta, the scanned Gift Card bills are preserved in original format as uploaded by the employees. We do not tamper or modify these bills. These bills are tax saving documents, which are stored forever on Zeta servers and can be produced as originally uploaded.

On this page:

- No labels