- Created by Super Admin, last modified by Seema on Jun 19, 2020

Overview

Know Your Customer (KYC) is a business process to verify your customer details such as identity and address proof as prescribed by RBI guidelines. The process ensures that a service is being consumed by a verified client and also aids financial institutions or other government authorities to prevent misuse of any financial transactions. As per RBI guidelines, beyond a specified amount it is mandatory that all prepaid payment instrument (PPI) users comply with KYC regulations and furnish required information and documentation.

RBI Mandate

- As per the RBI guidelines, you need to complete any one of the full KYC after your KYC expiry.

- The KYC update process would take 7-10 days from the time of submission.

Required KYC Documents

Zeta recommends corporates to submit the Officially valid document (OVD) of all employees or Zeta users in the onboarding stage to avoid any further interruption while using the Zeta tax benefit services. For example, you are allowed to add or receive money into your Zeta Wallet only with successful KYC verification. Zeta onboarding team will help you in case you need any assistance or clarification.

The documents that user may self-declare are:

- One passport size photograph.

- Government issued and self-attested copy of anyone photo ID proof, such as PAN Card, Passport, Driving License and Voter ID Card.

- Government issued and self-attested copy of anyone address proof, such as Passport, Driving License and Voter ID Card.

- Zeta KYC form duly filled up and signed by the employees.

KYC Profiles

As per the RBI guidelines, KYC is categorized into the following KYC profiles based on the business rules and privileges set on the legit modes of KYC.

Shortfall KYC

A user who has verified the mobile number but has not updated OVD in the system.

Minimum KYC

A user who has verified the mobile number and submitted a self-declaration of name and unique ID of any OVD such as PAN Card, Passport, Driving License and Voter ID Card.

Minimum KYC Expiry

Since your Minimum KYC profile is valid for one year. You can update your Minimum KYC or upgrade to the Full KYC profile. To know the procedural steps, refer Setting up an E-KYC.

Full KYC

You can submit the photocopies of your documents (OVD) and duly filled KYC form to an authorized Zeta representative. Please get in touch with your HR to complete the process.

Setting Up an E-KYC

Upgrade your Zeta Cash Card to avoid any payment errors while using Zeta. Read through the Rules and Zeta PPIs Limits limits as per RBI guidelines.

Know your KYC statuses associated with your KYC profiles below.

| KYC Profile | KYC status |

|---|---|

| Shortfall KYC |

|

| Minimum KYC |

|

| Full KYC (Aadhaar OTP KYC) |

|

Perform the following to begin your E-KYC or self-served KYC using the Zeta App.

RBL KYC

IDFC KYC

Kotak KYC

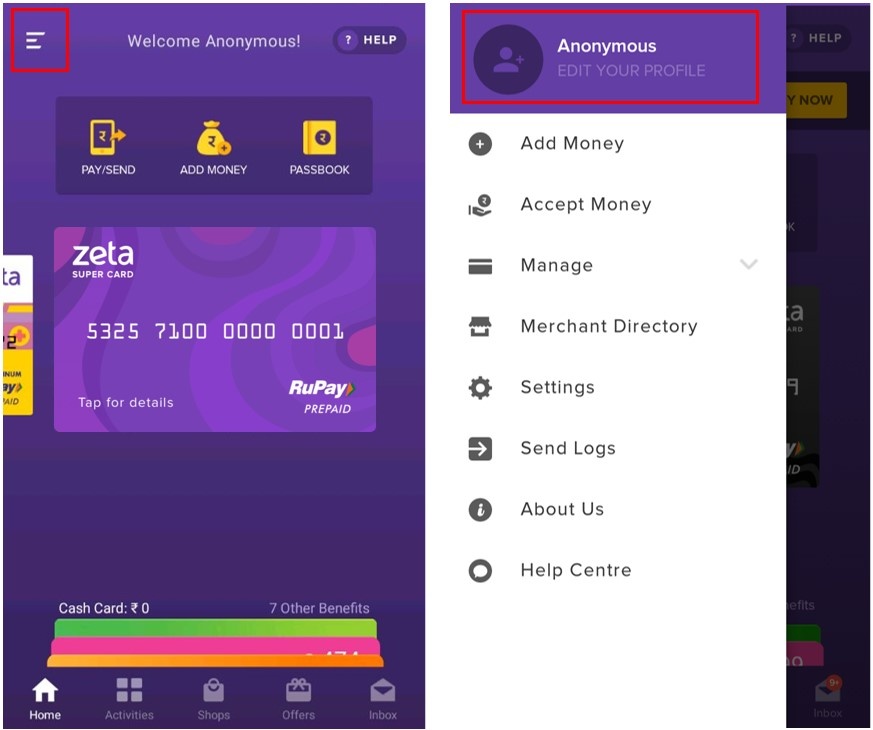

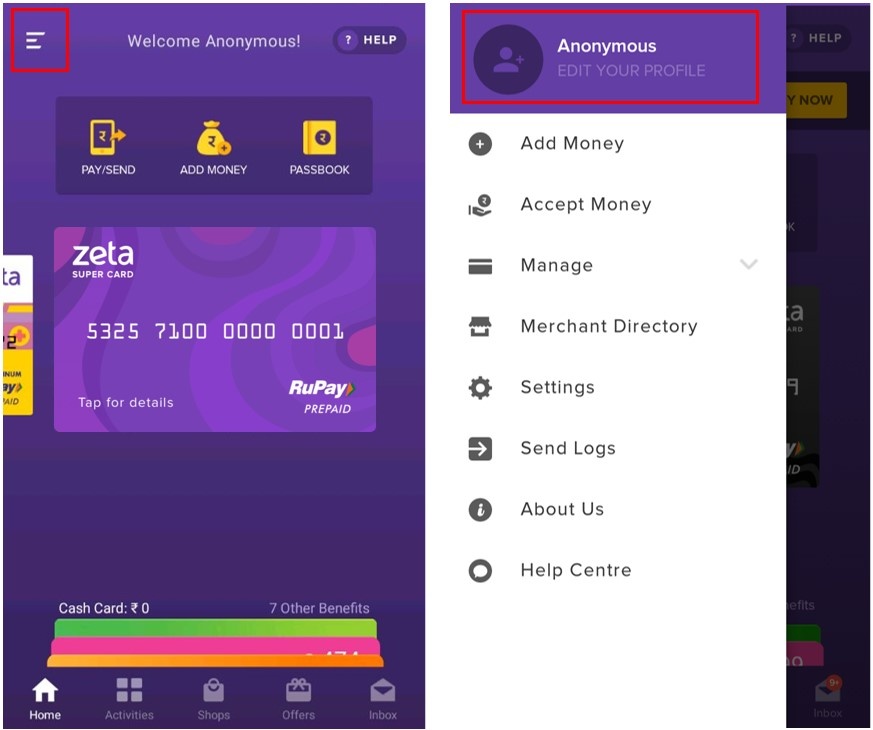

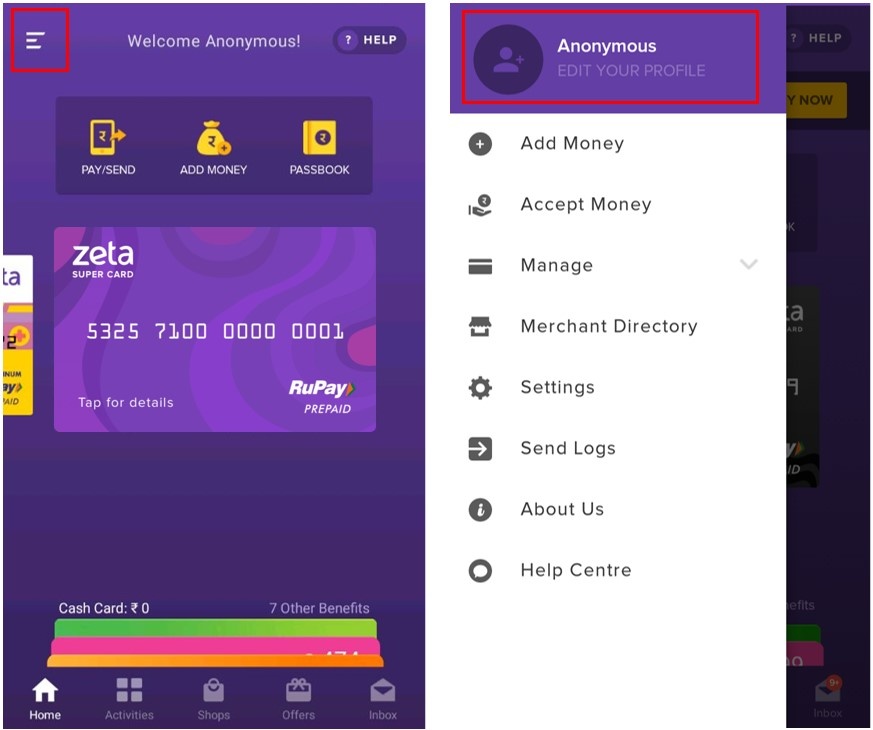

- Open Zeta App.

Tap hamburger icon (

) and then tap Edit Your Profile.

) and then tap Edit Your Profile.

- Tap Start KYC.

- Enter the below mentioned identity details and tap Continue.

- Enter your First Name and Last Name.

- Select the Document Type that you want to submit and enter the document's relevant ID Number.

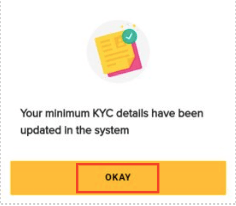

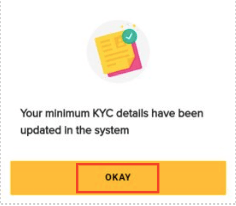

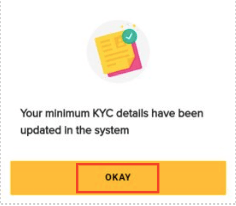

Your KYC details are successfully updated in the system. Tap Okay to exit the screen.

- Open Zeta App.

Tap hamburger icon (

) and then tap Edit Your Profile.

) and then tap Edit Your Profile.

- Tap Start KYC.

- Enter the below mentioned identity details and tap Continue.

- Enter your First Name and Last Name.

- Select the Document Type that you want to submit and enter the document's relevant ID Number.

Your KYC details are successfully updated in the system. Tap Okay to exit the screen.

- Open Zeta App.

Tap hamburger icon (

) and then tap Edit Your Profile.

) and then tap Edit Your Profile.

- Tap Start KYC.

- Enter the below mentioned identity details and tap Continue.

- Enter your First Name and Last Name (as per PAN Card).

- Select Gender and Date of birth.

- Enter your PAN Card Number.

Your KYC details are successfully updated in the system. Tap Okay to exit the screen.

KYC error scenarios

If you face any issue with setting up the minimum KYC process using Zeta App, contact the Zeta Support.

Know transaction limits

The set of rules on different KYC profiles and the list of acceptable transaction and balance limits with respect to Zeta payment instruments are listed below for your reference.

| Rules and PPI Limits | Shortfall KYC | Minimum KYC | Full KYC |

|---|---|---|---|

| Document required | None | Government approved ID* | Copy of Government approved ID* |

| Expiry | None | 1 year | Multiple years |

| Spend money via Zeta | Yes | Yes | Yes |

| Add money to Zeta | No | Yes | Yes |

| Zeta user/bank transfer | No | No | Yes |

| Maximum Balance | Existing Balance | 10,000 | 1,00,000 |

*PAN Card, Aadhaar Card, Passport, Driving License and Voter ID Card.