Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

What is Fusion?

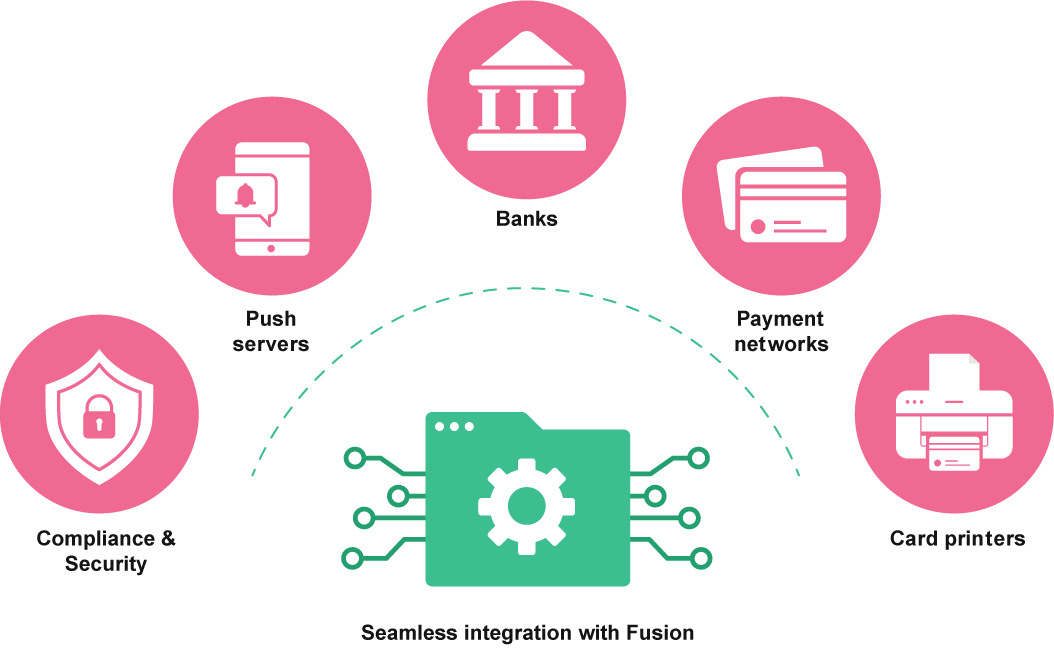

Fusion is an API-based Platform-as-a-Service (PaaS) offering. It enables fintechs to build and manage financial products for their unique use-cases. Fusion offers seamless integration with banks, payment networks, card printers, push servers, and several other services.

Fusion APIs solve multiple use-cases like customer loyalty cards, corporate gifting, expense management, merchant payouts, just-in-time account funding, and so on.

Why Fusion?

- Time-to-market: Fusion APIs provide you instant access to its financial ecosystem. Use Fusion's plug-and-play architecture to launch your products quickly.

Effortless integration: Fusion powers your team with interfaces and development environments required for effortless integration. Fusion provides RESTful APIs, webhooks, SDKs, private and production sandboxes, among other integration and extension mechanisms.

Comprehensive solution

Banking relationships on a platter:Fusion integrates with various banking technologies and service providers. It handles all the compliance, licensing, and data security requirements at its end.

Card order management:Fusion manages the entire card order life cycle from printing to delivery with its partner service providers.

Just-in-time account funding: With Fusion's Just-In-Time (JIT) account funding, you can load accounts with required amounts at the time of transaction. This eliminates the need to maintain account balance and unblocks funds.

Rich transaction policies: Fusion provides support for comprehensive spend controls using transaction policies. Create custom rules to limit spends for any account.

UPI Support: Account Holders can use Unified Payments Interface (UPI) to pay merchants and send funds to other Account Holders using any UPI application.

Virtual Bank Accounts: Virtual accounts are pseudo bank accounts with unique account numbers called ‘Virtual Account Numbers’ (VANs). Payments made to VANs (by NEFT, IMPS) are credited to a linked physical account (i.e. current account, saving account). Issue VANs to different parties for fund collection and disbursement purposes. VAN payments uniquely identify the payee, making reconciliation of all inward and outward payments hassle-free.

Note UPI support & VAN features are under development and will be released soon.

Scalability: Zeta works with multiple IFIs (banks) and the platform is

Span id ifi class tooltip agnostic. This guards Fusion fintechs against IFI side disruptions and provides for rapid fallback mechanisms. With a throughput of 1 million transactions per second (TPS), Fusion can handle any traffic volume scaling that businesses might demand.

- Compliance: Fusion complies with regulatory requirements to safeguard sensitive data. The platform adheres to data security standards including ISO 27001, PCI DSS, and AICPA SOC 2.

Tooltip id ifi text Issuing Financial Institute (IFI) is an institution that has the authority to offer financial services like accounts and loans. direction SW

What’s new?

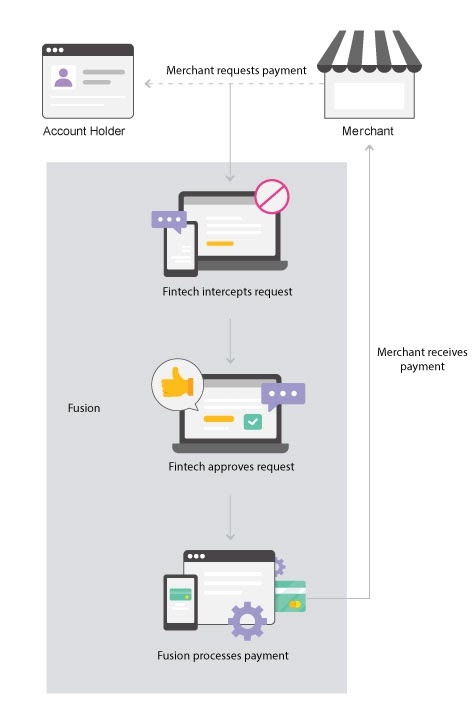

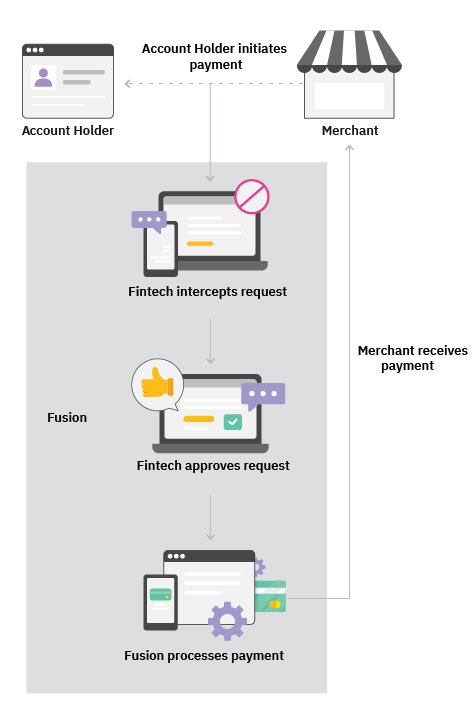

- Payment Interceptors: Payment Interceptors are HTTPS endpoints that can accept a payment request along with a callback URL. Using interceptors, fintechs can intercept a payment request, use their internal decision engines, and notify the decision back to Fusion using the callback URL to allow or disallow the payment. The following illustration gives a simplified view of how payment interceptors work. For detailed information, see Interceptors 101: A definitive guide.

Image Removed

Image Removed Image Added

Image Added

| Panel | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|