Overview

Digital disruption is continuously transforming the face of today's world, in fact creating a conducive ecosystem to bring about revolutionary and innovative changes. In an organization scenario, there is a dire need of redesigning the existing payroll allowances and claims system from an an old-fashioned, paper-based process to a paperless and hassle-free employee-friendly process. The key here is to adopt digital-first approach to reinvent the entire payroll benefit spectrum to drive a better employee experience.

Payroll Allowances & Reimbursements Today

Most of us know about common income tax saving instruments such as 80C or loss from house property since we are salaried professionals. There are other IT tax saving instruments, for example Payroll Allowances and Claims that offer income tax savings provided your organization allows you to opt for them. A typical payroll allowances and Reimbursements program may include meal vouchers, medical reimbursements, gift cards, communication reimbursements, fuel allowances, leave travel allowances and so on.

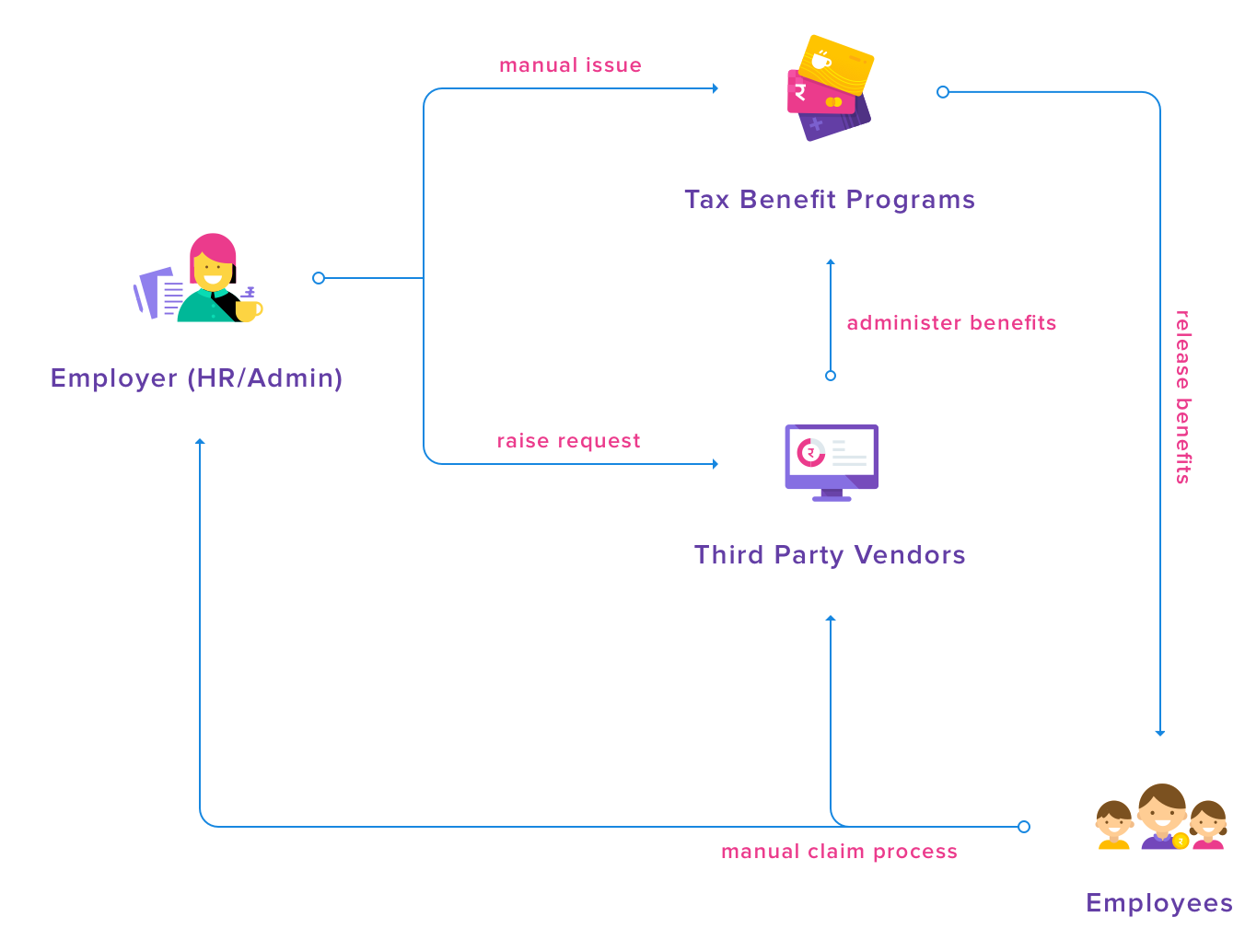

Till date, organizations are operating these benefit programs manually or through third-party finance outsourcing (see illustration below) that requires a painful administration with a considerable number of skillful workforces. Added to the agony, the entire procurement procedure takes several days to process a payroll benefit program. Employees run through a series of manual and time consuming effort to save income taxes on their hard-earned income.

Evidently, payroll benefit solutions available today are merely a third party support that is not scalable and comes with a huge investment. Due to lack of a secure payment infrastructure and agile approach, corporates often are restricted to use the old-fashioned solutions. A good number of corporates don't want to provide these tax saving benefits to their employees since the process is cumbersome and they are not exposed to a smarter and innovative approach to manage the benefit programs.

Transforming Payroll Benefits using Zeta Optima

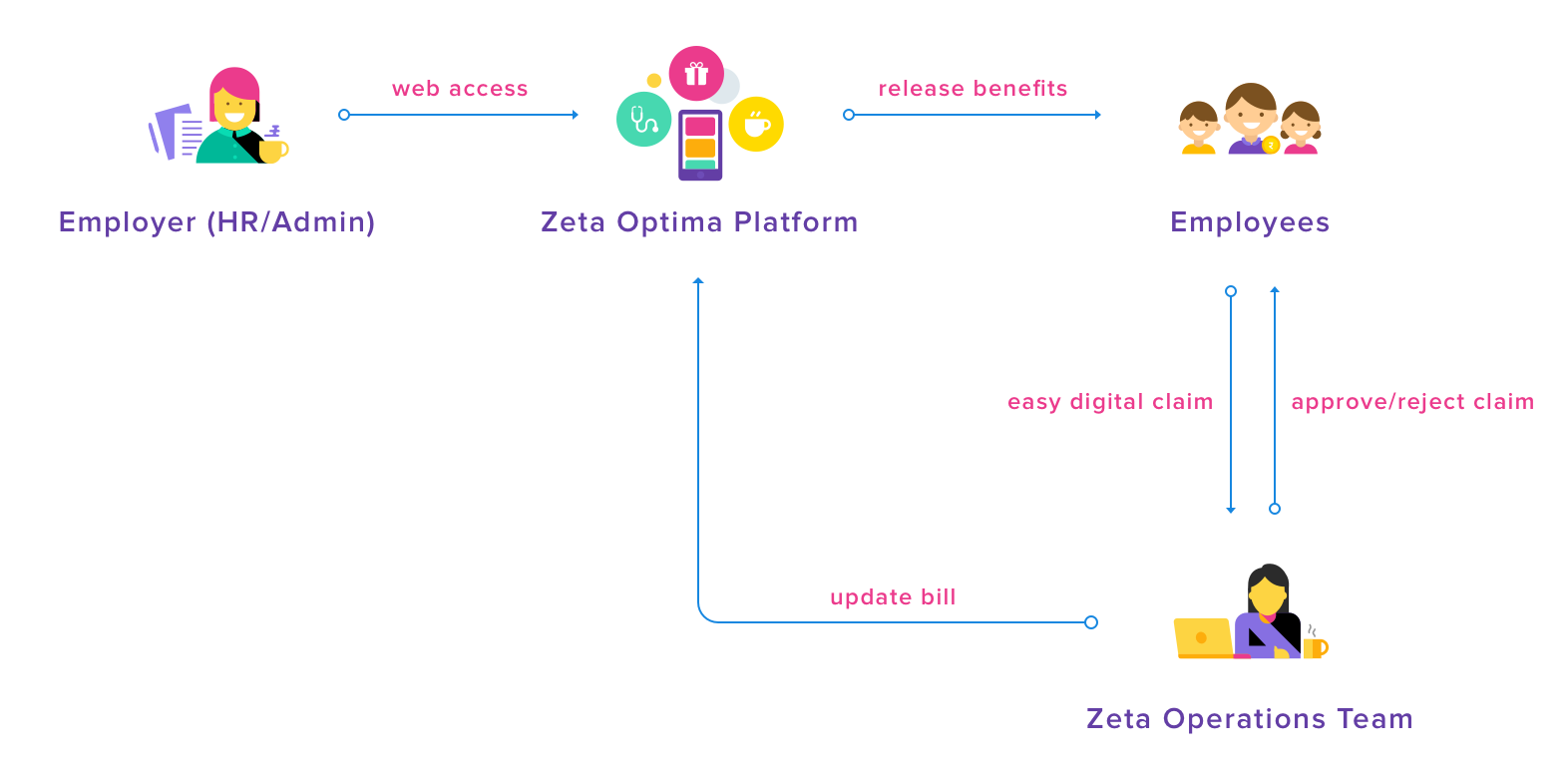

Zeta, an emerging business leader (business unit of Directi) in digital payment space, is perfectly poised to drive the employee benefit space and innovated a comprehensive Payroll Allowances and Claims management system - Zeta Optima platform for enterprise clients enabling them to digitize the employee tax benefits and rewards space.

Zeta Optima platform delivers the following benefits:

- One-stop digital solution that can manage all payroll allowances and reimbursements programs.

- Provides flexible and configurable allowances and reimbursements models that suit your needs. For example, you may choose from the programs such as meal vouchers (as an allowance program) or fuel cards (as an Allowance or a Reimbursement program) and many more based on your company policies.

- Easily integrates with an organization's human resources system to cater the need of payroll benefit programs

- Improves employee experience by enabling them with Zeta App and Zeta Web console to better organize their tax saving benefits.

- RBI compliant and adheres to income tax rules

- Go green and bye bye to paperwork forever

For Employee: As per the new RBI mandate, it is mandatory to update your identity details before December 31st, 2017 to continue receiving tax benefits on Zeta. Click here to know the steps to update identity details. For Employer: You have to validate any government issued valid ID of all employees receiving benefits from January 1st, 2018 and update the order file format for all PPIs to include the PAN/Aadhaar details of each employee. |

|