Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

Discover the important functional concepts related to Account Holders and Application. In this article, you learn about:

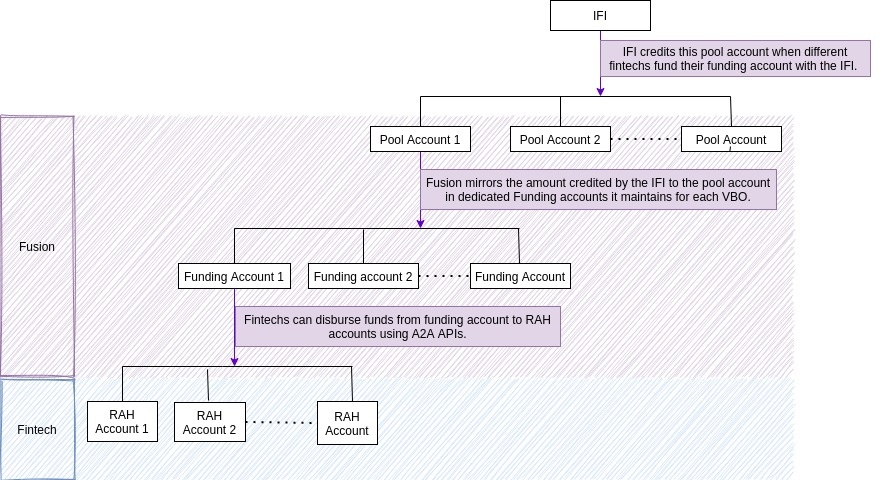

Pool account

Fintech creates a current account with an issuer. The fintech then funds the current account to enable the issuer to maintain a pool account in the banking system. The pool account is used to flow the money from the banking system to the fintech's funding account in the Zeta system.

Image Removed

Image Removed

Funding account

Funding Accounts are maintained on the Zeta system to keep track of the transactions that a fintech and its associated entities perform. Fintech can disburse funds from their Funding Account to Account Holder’s Account. Zeta may fund fintech's Funding Account basis standing instructions from the Issuer or request from fintech.

Real Account Holder (RAH) Account

Fintech creates an account for the on-boarded RAH in the Zeta system. This account can be funded by the fintech using their funding account. RAH can also load money through a Payment Gateway.

Multiple Accounts supported per Real Account Holder (RAH)

A single RAH can have multiple accounts across different fintechs using a single phone number and OVD (Officially Valid Document). However, in case of different phone number or OVD, there are 2 use-cases to consider as explained below:

Use-Case 1: A RAH uses the same phone number but two different OVD numbers to create two accounts with two fintechs. In such a case the entry for that particular RAH will be expanded in the system by adding both the provided OVD numbers.

Use-Case 2: A RAH uses the same OVD number but two different phone numbers to try to create accounts with two different fintechs. In such a case, since suspicion over the genuinity of the user arises, an error message will be sent out to the user asking to use a third phone number (Third phone number). If the RAH does not provide a third phone number, then an offline process involving the operations team checking the phone and OVD numbers will take place.

Bundle

Bundle is a construct through which you provision Account and Payment Products to your Account Holders. It is important to note that a Product can only be issued through a Bundle. Even if there is a single Product to be issued, it will be availed via the construct of a Bundle.

Account and Payment Products

As a fintech, you can use Bundles to package feature-rich business solutions or products and make them available to your Account Holders. In general, a Bundle consists of the following:

- Account Products: Prepaid accounts such as benefits, gift, petty cash,GPR and so on.

- Payment Products: Physical or virtual cards supported by Visa/RuPay/MasterCard networks.

You can configure many Bundles to address your liability use cases such as prepaid accounts. For example, a Bundle consisting of a reimbursement account (for example, petty cash or travel payments) to transfer expense-related settlements of Account Holders and a card powered by RuPay enabling Account Holders to spend the account balance.

Types of Account and Payment Products

Possible types of Account Products can be prepaid accounts such as benefits, gifts, petty cash, GPR and Payment Products can be physical/virtual cards supported by Visa/RuPay/MasterCard networks.

Fusion supported Products

Currently, Fusion supports liability use cases such as prepaid accounts for Account Products and physical/virtual cards for Payment Products.

Standard Bundles

Fusion provides the following pre-created Bundles that are used to offer liability products such as prepaid accounts to Account Holders.

You may wish to have some custom needs that are not part of pre-configured features. Contact Zeta Support for any custom needs. Fusion platform is flexible and designed to suit your custom business requirements.

GPR Bundle

General Purpose Reloadable (GPR) Bundles allow Account Holders to reload their accounts. Fintechs can make a distinction based on the KYC profiles of Account Holders. This can further be extended to allow users to utilize disbursed funds at POS, ECom terminals and so on. Following GPR Bundles are available:

GPR Min KYC

General Purpose Reloadable (GPR) Bundles allow Account Holders to reload their accounts. Fintechs can make a distinction based on the KYC profiles of Account Holders.

GPR Full KYC

Use this Bundle for Account Holders who have submitted Government ID details and have undergone full KYC verification. Fusion offers rich spend controls, you can restrict ECommerce and ATM/Point of sale (POS) transactions.

GPR Shortfall KYC

Use this Bundle for Account Holders who have verified the phone number but haven't submitted any KYC details. You may choose to configure a basic privileges such as viewing passbook to such users.

GPR with ATM support

This category can again take the KYC profiles into consideration. For example, an Account Holder with Aadhar OTP KYC would have more privileges like withdrawing the disbursed funds from ATM terminals free of charge.

GPR without ATM support

You can restrict ATM Support for Account Holders with min KYC users.

Gift Bundle

Gift Bundles are non-reloadable accounts that you can offer to Real Account Holders. These are bearer instruments i.e. an Account Holder who owns a gift card is entitled to the gift amount. Some custom configurations that you may wish to have, are listed below:

- Set service configurations like card validity, daily/monthly transaction limits or maximum number of transactions (in a given day) performed by an Account Holder.

- Restrict the usage of gift cards to affiliated merchant outlets.

- Choose your own card look and feel or design as per company branding guidelines.

Funding Account Bundle

Funding Account Bundle is used to create Funding Accounts for fintechs. Fintech disburse funds from their Funding Account to Account Holder’s Account. Funding Accounts are maintained with Zeta to keep track of the transactions that a fintech and its associated entities perform.

Custom Bundles

With Fusion, custom bundles that solve for the fintech's use case can be defined. Contact Zeta to know more about customizing products.

Bundle lifecycle

Using Bundles you can define and manage the lifecycle/workflows for Products within the scope of a Bundle.

Fusion lets you manage Bundles by allowing you to perform the following actions:

Sourcing

This stage primarily deals with exploring different channels, forums, advertising, or applications that an Issuer may use to generate demand for Bundles to their existing Account Holders.

Assessment

These are checks which are performed by fintechs as per defined policies. This workflow can help verify the KYC details of an Account Holder who is on-boarded into Fusion, hence allowing you to issue a Bundle or open an Account basis valid KYC status.

Provisioning

This consists of issuing Bundles to an Account Holder after successful assessment. It includes delivering Products and giving access to the Products as per Bundle configuration.

Provisioning includes the following:

- Deliver a welcome kit to an Account Holder.

- Inform affiliates about the new Account to enable bundled services. For example, insurance, priority check-in and so on.

- Support bundling of services provided by external systems along with the internal Bundle services.

Operations

This covers activities like daily operations including but not limited to blocking, unblocking, enabling or disabling a service.

Note that operation capabilities accessible to you by means of back-office tools or via Fusion APIs depend on the business agreement between you and IFI.

Closure

This includes actions to be taken in the event that an Account Holder wishes to permanently close the account. Closure may include the following activities:

- Instructions on balance transfer by means of cheque, cash or online transfer at the time of closure.

- Process on returning or collecting the resources associated with the account like physical cards.

| Panel | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|